Table of Contents

Cyber insurers have shifted decisively to technical underwriting. Your controls, evidence, and time‑to‑respond now drive both insurability and price. Requirements most frequently called out in 2025 include phishing‑resistant MFA, 24/7 EDR with active response, incident response readiness with proof of testing, third‑party risk oversight, and mailbox‑level email security that can detect social‑engineering/BEC attacks. The guidance below helps MSPs and enterprises align SLAs and day‑to‑day operations to what underwriters actually verify at renewal.

As the 2026 renewal cycle approaches, both Managed Service Providers (MSPs) and enterprise security teams face heightened scrutiny. Cyber insurers responded to rising loss complexity by tightening verification of technical controls during 2024–2025. That growth arrived with sharper expectations: controls like multi‑factor authentication (MFA), endpoint detection and response (EDR), incident response (IR) preparedness, and vendor oversight have moved from “recommended” to “required.” Organizations that fail to embed these into core IT and security processes risk higher premiums, reduced coverage, or denial.

What Changed in Underwriting (2024–2025)

Carriers have moved from generalized actuarial models to technical underwriting that evaluates how your controls actually perform. Munich Re projects the global cyber insurance market will reach $16.3 billion in 2025, underscoring that capacity is expanding—but favoring organizations with strong, evidenced defenses. Favorable rates increasingly hinge on real‑time monitoring, patch cadence, and demonstrable response capabilities. Some U.S. accounts saw modest premium relief in late 2024, according to Marsh, but it was conditional on stronger baselines. At the same time, many SMBs encountered denials due to missing MFA, weak response plans, or unmonitored endpoints, according to Sennovate. The headline: posture and proof now matter more than questionnaires alone.

Translate Insurer Expectations into Your Operating Model

Whether you’re an MSP packaging services or an enterprise CISO setting internal standards, bake insurer‑aligned controls into daily operations—not just policies.

MFA should be universal and phishing‑resistant where possible (e.g., FIDO2 or hardware keys). Underwriters increasingly ask for attestation that privileged, remote, and SaaS access is covered, with evidence of enforcement.

EDR needs to run on all in‑scope endpoints with 24/7 monitoring and active response. Carriers look for integrated SOC/MDR workflows that shorten detection and remediation windows and can show alert‑to‑action timelines.

IR maturity must be demonstrated, not declared. Keep a current plan, run and document tabletop exercises, retain a forensics/IR partner, and maintain a contactable on‑call roster. Insurers often request proof of the last exercise and the remediation items tracked to closure.

Vendor risk oversight is now part of many applications. Identify critical suppliers, record their security baselines or contractual obligations, and keep a lightweight but current evidence pack.

Continuous assessment beats annual snapshots. Quarterly vulnerability reviews with executive‑level summaries and tracked remediation show measurable control health over time.

From IT Provider to Risk Partner (MSP & Enterprise)

Conduct a pre‑underwriting review that mirrors carrier questionnaires and validates actual telemetry: MFA coverage, EDR agent health, patch status, IR artifacts, and vendor attestations. Present this as a concise “proof pack” before submission to reduce follow‑ups.

Tier your services or internal standards (e.g., baseline/plus/advanced) so departments or clients can align to escalating insurer requirements without bespoke contracts every time. Include explicit deliverables such as quarterly control health summaries and IR exercise cadence.

Automate evidence capture where feasible. Logs of MFA use, EDR coverage, incident timelines, and IR/playbook executions reduce audit thrash and improve renewal outcomes.

Educate stakeholders early in the renewal window. A short underwriting prep briefing avoids rushed changes under broker deadlines and sets expectations on what carriers will test.

Common Pitfalls That Undermine Insurability

Checkbox controls fail when configuration or coverage is thin. MFA with SMS fallback, EDR agents that are routinely offline, or stale IR call trees will not withstand scrutiny. Maintain documentation—screenshots, logs, policies, remediation reports—and keep sector‑specific requirements in view (e.g., encryption at rest, granular audit logs, privileged access workflows in healthcare and financial services).

90‑Day Runway to Renewal

Days 0–30: Establish scope and gaps. Inventory privileged access paths; measure MFA coverage; confirm EDR agent health; collect last IR tabletop outputs; list critical vendors and current attestations. Begin remediation of any “must‑have” gaps.

Days 31–60: Execute a tabletop; finalize vendor evidence; close high‑risk vulnerabilities; validate monitoring and alerting flows end‑to‑end (control → alert → action → log). Draft the underwriting proof pack.

Days 61–90: Freeze configurations where possible; package evidence; align with broker on any carrier‑specific asks; set up a standing cadence for quarterly updates so the next renewal is lighter.

Cyber Insurance Readiness Checklist

To prepare for new policies and renewals, confirm these are in place and evidenced:

- Organization‑wide MFA (preferably phishing‑resistant) with coverage reports

- EDR deployed and actively monitored on all in‑scope endpoints, with alert‑to‑action timelines

- Documented and recently tested IR plan with tracked remediation from the last exercise

- Forensics/IR retainer and on‑call roster

- Quarterly vulnerability management with executive summaries and remediation tracking

- Critical vendor list with baseline security attestations or contractual requirements

- Employee awareness artifacts (phishing/BEC training, reporting workflows)

- Centralized logging with retention for control activity and incident timelines

Have this “proof pack” ready before applications go out to compress underwriting cycles.

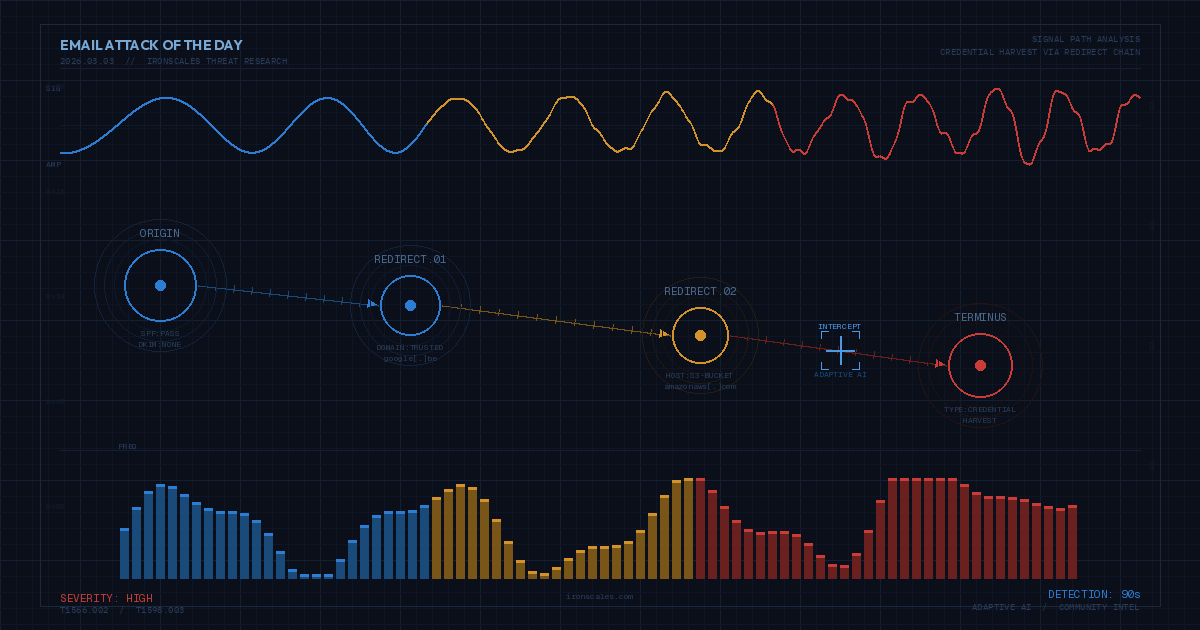

The IRONSCALES Platform and Insurance Attainment/Renewal

IRONSCALES supports several control areas frequently evaluated by underwriters. Operating inside the inbox via API. It provides mailbox‑level detection for phishing and BEC, continuous remediation, and user‑report workflows. These capabilities can help demonstrate real‑time detection and response for email‑borne threats (evidence via incident timelines and remediation logs), employee engagement in reporting and awareness (evidence via training/simulation records and user‑report telemetry), and centralized, exportable artifacts useful for underwriting proof packs (e.g., classification decisions, quarantine/remediation history).

For MSPs, this alignment can be packaged into SLAs and quarterly executive summaries. For enterprises, it provides ongoing evidence that bridges day‑to‑day protection and insurance readiness.

Position Yourself For Success

Cyber insurance underwriting has evolved from actuarial modeling to technical verification. Security leaders must now demonstrate that controls operate effectively in production, with evidence readily available. Email security—particularly the ability to detect and respond to sophisticated phishing and BEC attacks at the mailbox level—has emerged as a critical but often overlooked component of insurance readiness.

Organizations that embed insurer-aligned controls into daily operations, automate evidence capture, and maintain continuous monitoring will find renewals become business-as-usual rather than annual fire drills. Start your 90-day preparation cycle now.

Explore More Articles

Say goodbye to Phishing, BEC, and QR code attacks. Our Adaptive AI automatically learns and evolves to keep your employees safe from email attacks.

/Concentrix%20Case%20Study.webp?width=568&height=326&name=Concentrix%20Case%20Study.webp)

%20for%20Cybersecurity%20Insurance.webp)

.webp?width=100&height=100&name=PXL_20220517_081122781%20(1).webp)