Table of Contents

A Market in Transformation

The managed services M&A market is seeing a big jump in activity. Every week, I hear from partners navigating mergers, private equity deals, or strategic exits. According to MSP Business Insights, M&A activity in the MSP channel grew 50% in 2024, returning to 60% of 2021 levels, and early indicators suggest 2025 will surpass even those figures.

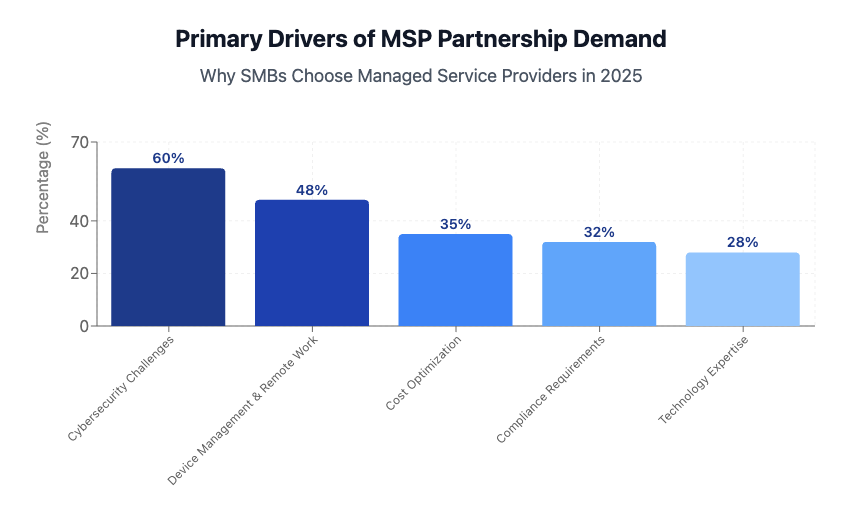

Why is this happening? Demand is shifting. The Channel Futures MSP Market Survey found that almost 90% of SMBs currently use an MSP to handle some of their IT needs or are considering it.This isn't just growth, but a fundamental reordering of how IT services are delivered and consumed.

For smaller MSPs, understanding these forces is extremely important. The decisions you make in the next 12-18 months will determine whether you thrive in this new landscape or become part of someone else's growth strategy.

The Forces Driving Consolidation

Three interconnected dynamics are accelerating market consolidation, each creating both opportunities and pressures for service providers.

- Private Equity's Appetite for Predictable Revenue

A Private Equity Technology Investment Report found that 57% of private equity respondents expect an increase in deal volume over the next 12 months, drawn by the MSP model's recurring revenue characteristics. Private equity firms recognize that well-run MSPs generate predictable cash flows with high customer retention rates, making them attractive assets in uncertain economic times.

This capital influx creates a cascading effect. Well-funded acquirers can offer compelling valuations to MSPs with strong fundamentals, while simultaneously putting competitive pressure on providers who haven't optimized their operations for scalability and profitability.

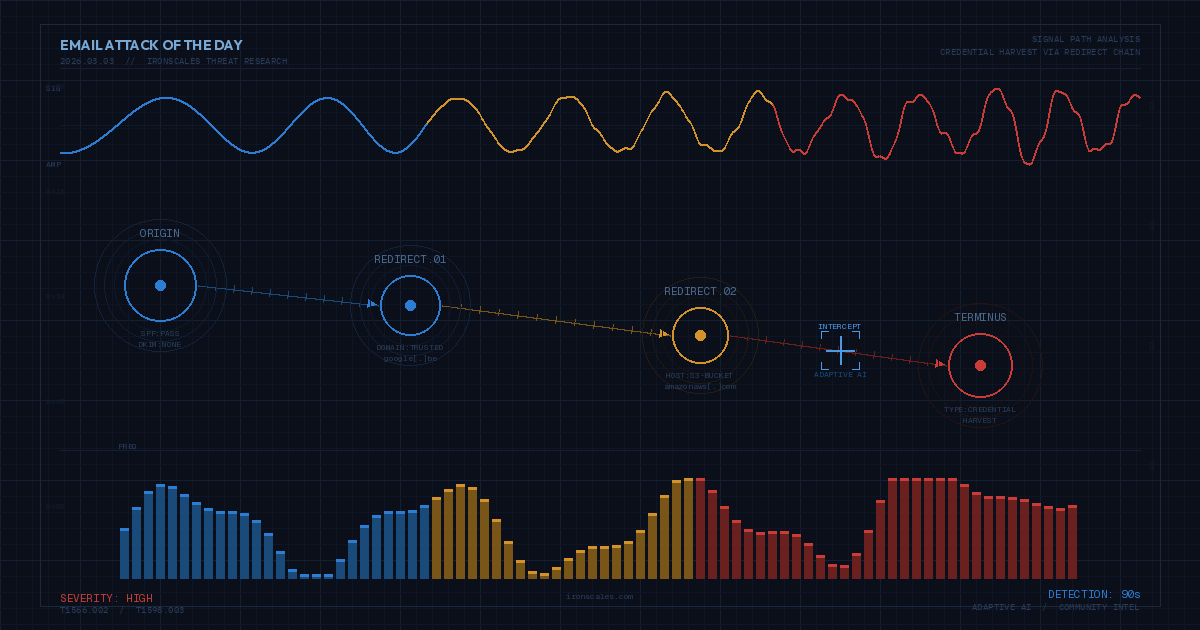

- Cybersecurity as the New Competitive Battleground

The cybersecurity imperative has fundamentally altered client expectations. Technology Business Research's MSP Client Preference Study found that increased security (at a whopping 46 percent) ranks as the top reason organizations work with MSPs, reflecting a shift from reactive IT support to proactive risk management.

This growth creates immense opportunity, but also raises the bar for service delivery. Clients no longer view cybersecurity as an add-on service; they expect integrated security woven throughout their technology stack.

The implication for MSPs is profound: those who can't deliver comprehensive security capabilities risk becoming commodity providers competing solely on price.

- Market Concentration and Service Standardization

According to CyVent's market consolidation forecast, industry consolidation will reduce the current top 200 MSSPs to about 120 by 2028. This consolidation reflects both the advantages of scale and the challenges facing smaller providers.

Larger MSPs can invest in automation, standardized processes, and specialized expertise that smaller providers struggle to match. They can also navigate complex compliance requirements more efficiently, making them attractive partners for enterprise clients with stringent regulatory needs.

Strategic Response Framework: Three Pathways Forward

The data suggests successful MSPs are choosing one of three distinct strategic paths. Each requires different capabilities, investments, and risk tolerance, but all can lead to sustainable competitive advantage when executed with discipline and focus.

Path 1: Scale Through Operational Excellence

Scaling isn't about growing headcount, it's about building systems that can handle increased volume without proportional increases in complexity or cost. Channel Partners' Regional MSP Growth Projections report indicates the APAC region is likely to see the highest growth in 2025, around 15%, while EMEA and North America will trail slightly, at approximately 12% and 10% respectively, indicating that growth opportunities exist globally for providers who can scale effectively.

- Automation as the Foundation: Successful scaling requires eliminating manual processes wherever possible. This means investing in orchestration platforms that can handle routine tasks, standardized incident response procedures, and automated reporting systems that provide clients with real-time visibility into their IT environment.

- Technology Stack Consolidation: The most scalable MSPs minimize the number of tools their teams must master. Choose platforms that integrate naturally, provide centralized management capabilities, and can adapt to different client environments without extensive customization.

- Service Tier Architecture: Structure your offerings around clear, measurable outcomes rather than activity-based metrics. This allows you to price based on value delivered rather than time spent, improving both profitability and client satisfaction.

Path 2: Specialize for Premium Positioning

According to the MSP Alliance's IoT Management Services Survey, 78% of organizations view MSPs as a solution for Internet of Things (IoT) management, indicating significant opportunity for providers who develop deep expertise in emerging technology areas or specific industry verticals.

- Vertical Market Focus: High-compliance industries like healthcare, financial services, and legal offer the strongest opportunities for specialization. These sectors face unique regulatory requirements, have specific technology needs, and typically demonstrate higher willingness to pay premium prices for specialized expertise.

- Deep Domain Knowledge: Specialization requires more than surface-level familiarity with industry terminology. Develop genuine expertise in your chosen vertical's regulatory environment, operational challenges, and strategic priorities. This knowledge becomes a competitive moat that's difficult for generalist competitors to replicate.

- Playbook Development: Codify your specialized knowledge into repeatable processes and methodologies. This allows you to deliver consistent value while reducing the time required to onboard new clients and scale your specialized services.

Path 3: Build for Strategic Value

Even if you're not planning an immediate exit, building your MSP with acquisition potential creates operational benefits while preserving future optionality.

- Financial Discipline: Focus relentlessly on metrics that matter to potential acquirers—monthly recurring revenue, gross margins, customer churn rates, and revenue concentration. These metrics also happen to indicate overall business health, making this focus beneficial regardless of exit intentions.

- Operational Maturity: Standardize processes, document procedures, and centralize critical business functions. This makes your business less dependent on any one person and more appealing to buyers looking for stable, scalable operations.

- Client Portfolio Optimization: Diversify your revenue base to reduce concentration risk while focusing on clients who value long-term partnerships over transactional relationships. This creates more stable cash flows and higher valuations.

Implementation Priorities: Where to Start

Regardless of which strategic path you choose, certain foundational capabilities are essential for competing effectively in the evolving MSP landscape.

- Security Integration: Security capabilities are essential for competing effectively on this new playing field. This doesn't necessarily mean becoming a full-scale MSSP, but you must be able to deliver integrated security that meets your clients' risk management needs.

- Operational Metrics: Implement systems that provide real-time visibility into key performance indicators (KPIs). You can't manage what you don't measure, and the MSPs that thrive will be those who can demonstrate measurable outcomes to their clients. As well as convey strong metrics to potential buyers should they decide to sell.

- Team Development: The Channel Ecosystem Report's MSP Partner Market Analysis projects around 341,000 partners will be delivering managed services by the end of the year, indicating intense competition for skilled technical talent. Invest in training and development programs that help your team stay current with evolving technologies and client needs. Retention will remain a huge problem within the space and maintaining a healthy employee experience is key.

Looking Ahead: The Next 18 Months

According to the MSP M&A Quarterly Report, M&A activity has shown building momentum with announced deal values reflecting a +8% gain over Q4 2024 and +15% gain over Q1 2024, suggesting that consolidation pressures will continue intensifying throughout the remainder of this year.

For smaller MSPs, this creates urgency around strategic positioning. The providers who emerge stronger from this period will be those who make decisive moves now—whether that means scaling operations, developing specialized capabilities, or positioning for strategic partnership or acquisition.The market is clearly rewarding clarity and execution over hesitation. The opportunity is significant, but the window for positioning won't remain open indefinitely.

The fundamental question isn't whether the MSP market will continue consolidating—it's whether you'll be driving that consolidation or responding to it. Your strategic choices over the next 18 months will determine the answer.

Explore More Articles

Say goodbye to Phishing, BEC, and QR code attacks. Our Adaptive AI automatically learns and evolves to keep your employees safe from email attacks.

/Concentrix%20Case%20Study.webp?width=568&height=326&name=Concentrix%20Case%20Study.webp)